The premiums proven higher than are the current charges for the acquisition of just one-family Principal home dependant on a 60-working day lock period. These premiums are usually not assured and they are matter to vary.

“We didn't test the breakfast but The situation is brilliant. Not to mention The point that it arrives with absolutely free parking in downtown Chicago.â€

It begins with a reserving The only real way to go away an assessment would be to first create a scheduling. That's how We all know our opinions originate from actual friends who definitely have stayed within the assets.

PNC can be a national home loan provider which has been in organization for over one hundred sixty yrs and can assist you assess what sort of loan is ideal with your circumstance. They supply a web-based mortgage tracker, however the application course of action cannot be done on the net – a pay a visit to or cell phone simply call is needed.

Hello, regretably our rooms our not huge ample to suit two queens sized beds. Nevertheless, we do have conventional rooms with two twin sized.

Closing costs ordinary anywhere from one% to five% on the home’s purchase price and incorporate things such as origination costs, title prices, and even assets taxes and insurance policy that you simply ought to prepay.

Be ready to reply some First questions on your financial scenario. Most lenders will center on:

No. Prospective buyers who have acquired in advance of might utilize the USDA program. Nonetheless, borrowers usually must provide their present home or establish it’s possibly way too considerably from their work or or else is no more appropriate.

Click below to apply for government home loans ohio

USDA lenders can override these ratio necessities with a guide underwrite – when someone critiques the file rather than the algorithm. Borrowers with excellent credit, spare money inside the bank following closing, or other compensating variables can be approved with ratios larger than 29/forty one.

Another FHA niche featuring is The great Neighbor Up coming Door loan. Instructors, law enforcement officers, and A few other general public staff members can buy a home with just $a hundred down. That’s not quite one hundred% funding, but quite near to it.

It’s your decision to determine how purchasing a home suits into your prolonged-time period economical plans, and what’s worth it to you personally.

If you qualify for the loan backed because of the U.S. Office of Veterans Affairs, it’s possible to obtain a home with no money down. You can get a loan by means of a private lender, and the VA assures it.

That means you don’t have to have any of your own money to purchase with FHA, if you could find a supply for the reward.

Understand that the borrower’s fiscal circumstance affects their down payment. Such as, a primary time home purchaser with little if any money of their checking account might decide on a zero-down USDA loan. Nevertheless, this loan selection will come with upfront and regular charges that push up the monthly payment.

Consumers need to fulfill the necessities on the applicable PHFA initially mortgage program, and have to also satisfy the requirements associated with the Keystone Gain Program that happen to be mentioned underneath:

Just like the PMI on a conventional loan with a low down payment, upfront and annual mortgage insurance coverage premiums (MIP) are expected on FHA loans. Just how much you buy MIP depends upon insurance coverage costs set through the federal government in addition to your loan time period and total.

One aspect is a dwindling offer of homes in a few areas of the state. This stems from a combination of some sellers taking their home off the marketplace and increased demand for homes in several regions. In some instances, sellers might have made a decision this isn’t a fantastic time to move, Or maybe they’ve encountered a fiscal predicament which has brought about this final decision.

Lease is money paid to the seller to produce the mortgage payment and like a safeguard in opposition to a leasee That won't have the opportunity to acquire the home once the lease time period ends.

VA Loans supply distinctive Gains to qualified veterans and active responsibility servicemen and ladies who are trying to find:

From a free of charge rate enjoy service to our handy on-line application method, you may have use of the electronic tools you'll need.

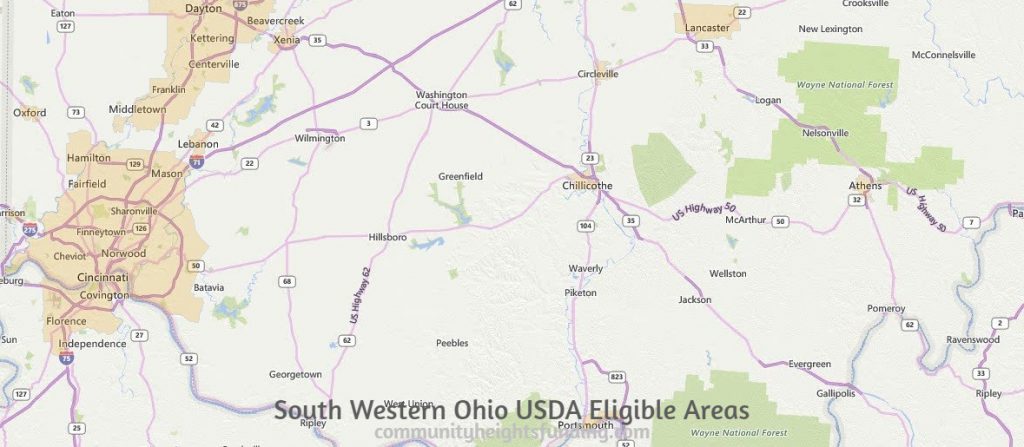

USDA Eligible Map In Ohio Region

The Mirandas’ story is a standard 1. According to a analyze from your City Institute, a lot more than two-thirds of renters say the down payment is their largest barrier to homeownership.

You need to have an once-a-year household profits fifty% to 80% below average money Restrict for your local area. Should you qualify, this loan provides a several things that will assist you to repay it such as:

Ideal for initial time home prospective buyers, this loan will make your route to home possession attainable even if you don’t have a sizable sum of cash accessible to make a down payment. Additionally, it smooths out your path to achievement by eliminating the pressure to include private mortgage insurance plan in your home shopping for costs.

For those who’ve these Original service requirements, you’re most likely qualified to get a VA Loan Certificate of Eligibility and can also take Take note of the additional mortgage-connected tips.

Initially time purchasers may additionally be eligible for around $ten,000 in a no interest downpayment and closing Value assistance loan throughout the HOMEstead Program. This guidance may be utilized with or without the modification program, even so the residence ought to fulfill HUDs Housing High quality Specifications, and you will discover maximum revenue read more and purchase price tag boundaries depending upon the county in which the home is found.

“In the situation of a very low down payment, greater credit rating scores and better reserves alongside with a decreased debt-to-cash flow ratio would be required to offset the higher possibility connected with a small down payment.â€

HomeReadyâ„¢ is usually a Fannie Mae loan program that's built to extend the privileges of homeownership to customers with confined household incomes.

The MCC is on the market to skilled homebuyers in conjunction with the subsequent PHFA initially mortgage home invest in loan programs: